Growth partners for SMBs and Mid-Market Firms

Growth partners for SMBs and Mid-Market Firms

Growth partners for SMBs and Mid-Market Firms

Accelerate Growth,

Maximize Value,

Accelerate Growth,

Maximize Value,

Accelerate Growth, Maximize Value,

or Plan Your Exit

or Plan Your Exit

or Plan Your Exit

Fractional CXOs, Growth Capital & Investments, M&As

Fractional CXOs, Growth Capital & Investments, M&As

Fractional CXOs, Growth Capital & Investments, M&As

Growth partners for SMBs and Mid-Market Firms

Accelerate Growth,

Maximize Value,

or Plan Your Exit

Fractional CXOs, Growth Capital & Investments, M&As

ABOUT US

Prestiza Equity Group is dedicated to transforming SMB and mid-market businesses by driving profitable growth and ensuring reduced market shift risk in the long term

ABOUT US

Prestiza Equity Group is dedicated to transforming SMB and mid-market businesses by driving profitable growth and ensuring reduced market shift risk in the long term

Our consortium of 100+ seasoned operators and investors brings years of experience and millions in growth capital to the table in order to help companies scale efficiently, maximize financial success, and secure tax-optimised exits when the time is right

Our consortium of 100+ seasoned operators and investors brings years of experience and millions in growth capital to the table in order to help companies scale efficiently, maximize financial success, and secure tax-optimised exits when the time is right

Prestiza’s mission is to partner with business owners and management teams of organizations to develop and scale transformative solutions that grow profit and company valuation. Prestiza propels growth in small and medium businesses across diverse sectors through strategic Fractional CXO Services, Growth Capital and Investments, and Mergers & Acquisitions

Prestiza’s mission is to partner with business owners and management teams of organizations to develop and scale transformative solutions that grow profit and company valuation. Prestiza propels growth in small and medium businesses across diverse sectors through strategic Fractional CXO Services, Growth Capital and Investments, and Mergers & Acquisitions

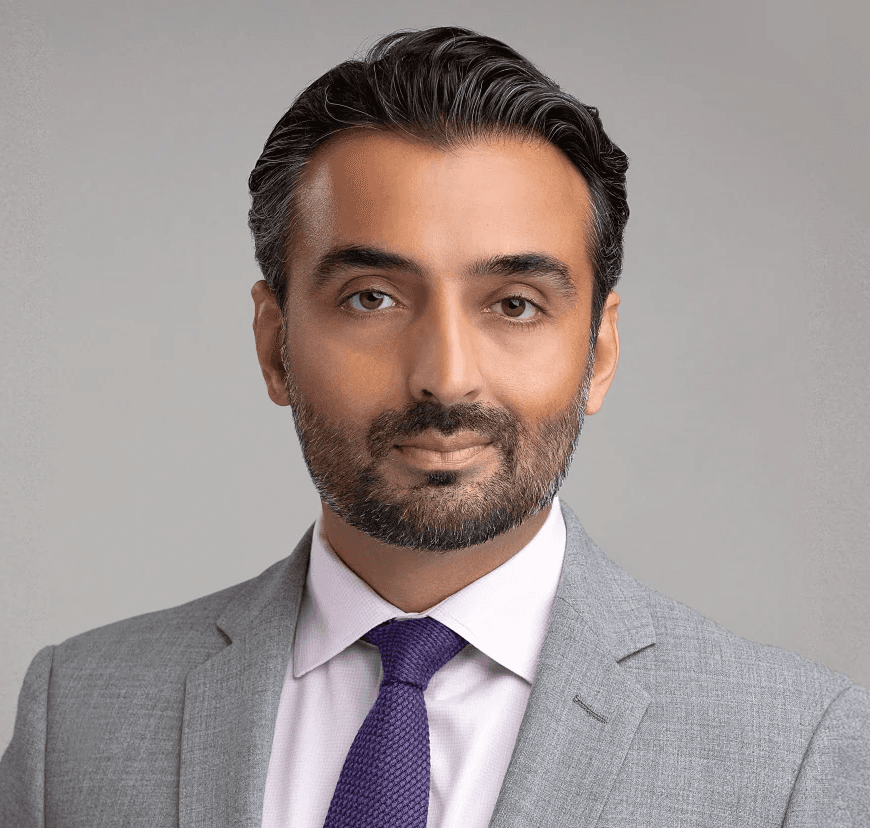

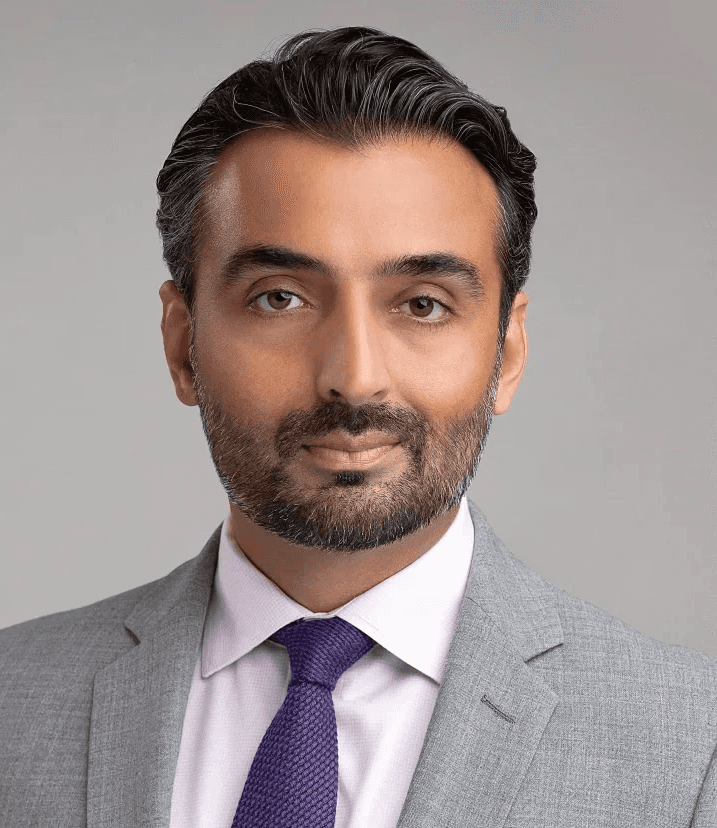

After 25 years in large enterprises, I felt disconnected from the true impact of my work. During a career break, I discovered that many small and mid-sized businesses were struggling with stagnation and lacked viable exit strategies. This inspired me to create Prestiza Equity Group, where we help such companies thrive, using our expertise, capital, and network to make a lasting, positive impact.

Ayaz Hameed

Founder & Managing Director

After 25 years in large enterprises, I felt disconnected from the true impact of my work. During a career break, I discovered that many small and mid-sized businesses were struggling with stagnation and lacked viable exit strategies.

Ayaz Hameed

Founder & Managing Director

After 25 years in large enterprises, I felt disconnected from the true impact of my work. A career break revealed the struggles of SMBs and mid-market firms with stagnation and viable exit strategies. This inspired me to create Prestiza Equity Group, where we help such companies thrive and make a lasting positive impact in the lives of all the stakeholders of such companies.

Ayaz Hameed

Founder & Managing Director

SERVICES

Prestiza provides business owners with a seamless, efficient, and tax-advantaged exit or growth capital and expert advisory services to enhance business value in preparation for a future exit

SERVICES

Prestiza provides business owners with a seamless, efficient, and tax-advantaged exit or growth capital and expert advisory services to enhance business value in preparation for a future exit

What distinguishes us from traditional private equity, consulting, and venture firms is as follows:

What distinguishes us from traditional private equity, consulting, and venture firms is as follows:

01.

Our expansive professional network across diverse sectors

02.

Fractional C-suite services across all business functions

03.

Proven frameworks for exponential growth

04.

Innovative deal structures, investment and tax strategies

05.

Technology-driven solutions—tailored specifically to the needs of each business

02.

01.

01.

01.

Fractional C-suite services across all business functions

Our expansive professional network across diverse sectors

Our expansive professional network across diverse sectors

Our expansive professional network across diverse sectors

02.

Fractional C-suite services across all business functions

Fractional C-suite services across all business functions

02.

Fractional C-suite services across all business functions

03.

Proven frameworks for exponential growth

Proven frameworks for exponential growth

Proven frameworks for exponential growth

04.

Innovative deal structures, investment and tax strategies

Innovative deal structures, investment and tax strategies

Innovative deal structures, investment and tax strategies

05.

Technology-driven solutions—tailored specifically to the needs of each business

Technology-driven solutions—tailored specifically to the needs of each business

Technology-driven solutions—tailored specifically to the needs of each business

Technology-driven solutions—tailored specifically to the needs of each business

01

Fractional CXO & Advisory

01

Fractional CXO & Advisory

01

Fractional CXO & Advisory

02

Growth Capital & Investment

02

Growth Capital & Investment

02

Growth Capital & Investment

03

Mergers & Acquisitions

03

Mergers & Acquisitions

03

Mergers & Acquisitions

Companies we partner with usually

look like this:

Companies we partner with usually look like this:

01.

Typically under $10MM in revenue and between $750k-$4MM EBITDA - there are always exceptions

Typically under $10MM in revenue and between $750k-$4MM EBITDA - there are always exceptions

02.

The company is doing well but the business owners wants to hand it over to someone else for the next growth phase

The company is doing well but the business owners wants to hand it over to someone else for the next growth phase

03.

The company is profitable but the growth has been stagnant for many years. The owner is tired and lacks the energy and/or expertise to grow the business

The company is profitable but the growth has been stagnant for many years. The owner is tired and lacks the energy and/or expertise to grow the business

04.

Venture Investor Buy-Out - The owner has raised some money and built a good business with serious revenue and maybe some profit, but can't achieve venture scale.

Venture Investor Buy-Out - The owner has raised some money and built a good business with serious revenue and maybe some profit, but can't achieve venture scale.

05.

Co-Founder/Employee Buy Out - The owner has got early employees, investors, or co-founders who want to leave or cash out. Owner wants to swap them for a friendly new face

Co-Founder/Employee Buy Out - The owner has got early employees, investors, or co-founders who want to leave or cash out. Owner wants to swap them for a friendly new face

01.

Fractional CXO & Advisory

01.

Fractional CXO & Advisory

02.

Growth Capital & Investment

02.

Growth Capital & Investment

03.

Mergers & Acquisitions

03.

Mergers & Acquisitions

Companies we partner with usually

look like this:

01.

Typically under $10MM in revenue and between $750k-$4MM EBITDA - there are always exceptions

02.

The company is doing well but the business owners wants to hand it over to someone else for the next growth phase

03.

The company is profitable but the growth has been stagnant for many years. The owner is tired and lacks the energy and/or expertise to grow the business

04.

Venture Investor Buy-Out - The owner has raised some money and built a good business with serious revenue and maybe some profit, but can't achieve venture scale.

05.

Co-Founder/Employee Buy Out - The owner has got early employees, investors, or co-founders who want to leave or cash out. Owner wants to swap them for a friendly new face

Our goal is to reduce business risks and enable our clients to achieve their strategic goals. We analyse, develop, and implement solutions using our years of experience and expert skills for our customers.

Our goal is to reduce business risks and enable our clients to achieve their strategic goals. We analyse, develop, and implement solutions using our years of experience and expert skills for our customers.

Our goal is to reduce business risks and enable our clients to achieve their strategic goals. We analyse, develop, and implement solutions using our years of experience and expert skills for our customers.

Our goal is to reduce business risks and enable our clients to achieve their strategic goals. We analyse, develop, and implement solutions using our years of experience and expert skills for our customers.

PROJECTS

At Prestiza, we've collaborated with hundreds of business owners to enhance operations, drive growth through acquisitions and partnerships, and facilitate profitable, tax-efficient exits. Our team of subject matter experts across a diverse set of industries is equipped to help businesses achieve their full potential.

At Prestiza, we've collaborated with hundreds of business owners to enhance operations, drive growth through acquisitions and partnerships, and facilitate profitable, tax-efficient exits. Our team of subject matter experts across a diverse set of industries is equipped to help businesses achieve

their full potential.

At Prestiza, we've partnered with 100s of business owners and shareholders to transform their companies by any of streamlining operations to increase revenue and profits, growing through acquisitions and partnerships, or facilitating tax-optimized, profitable exits. Our consortium of 100+ seasoned professionals has been exercising the expertise needed to help any business achieve any goals envisioned by their owners

Transforming a $10MM Commercial General Contractor

2024

VIEW PROJECT

Transforming a $10MM Commercial General Contractor

2024

VIEW PROJECT

Unblocking the sales bottleneck for a $8.5MM Custom Software Development and IT Services Company

2024

VIEW PROJECT

Unblocking the sales bottleneck for a $8.5MM Custom Software Development and IT Services Company

2024

VIEW PROJECT

Empowering an Insurance Business to Drive Exponential Growth

2024

VIEW PROJECT

Empowering an Insurance Business to Drive Exponential Growth

2024

VIEW PROJECT

OUR PEOPLE

Our team comprises a network of investors, technologists and subject matter experts (SMEs) from diverse industries including software, e-commerce, IT Services, and construction. Our dedicated professionals drive success through strategic insight and robust financial expertise. Join us to transform your business

Our team comprises a network of investors, technologists and subject matter experts (SMEs) from diverse industries including software, e-commerce, IT Services, and construction. Our dedicated professionals drive success through strategic insight and robust financial expertise. Join us to transform your business

OUR PEOPLE

Our team comprises a network of investors, technologists and subject matter experts (SMEs) from diverse industries including software, e-commerce, IT Services, and construction. Our dedicated professionals drive success through strategic insight and robust financial expertise. Join us to transform your business

CONTACT US

We look forward to learning how we can help you.

Contact us

Info@prestizaequity.com

Contact us

Info@prestizaequity.com

Sitemap

Copyright Prestiza 2023. All Right Reserved created by Hasnain Gilani

Sitemap

Copyright Prestiza 2023. All Right Reserved created by Hasnain Gilani

Sitemap

Copyright Prestiza 2023. All Right Reserved created by Hasnain Gilani

Sitemap

Copyright Prestiza 2023. All Right Reserved created by Hasnain Gilani